In the realm of digital finance, few phenomena captivate the imagination and intrigue of enthusiasts, quite like Bitcoin halving. Representing a fundamental aspect of Bitcoin’s design, halving events serve as pivotal milestones that shape the cryptocurrency’s economic landscape and influence market dynamics. As we embark on a journey to unravel the mysteries surrounding Bitcoin halving, we delve into some of the basics of Bitcoin, mining and halving before exploring its impact on supply and demand, its historical significance, and the implications for the future of digital finance.

What is Bitcoin halving?

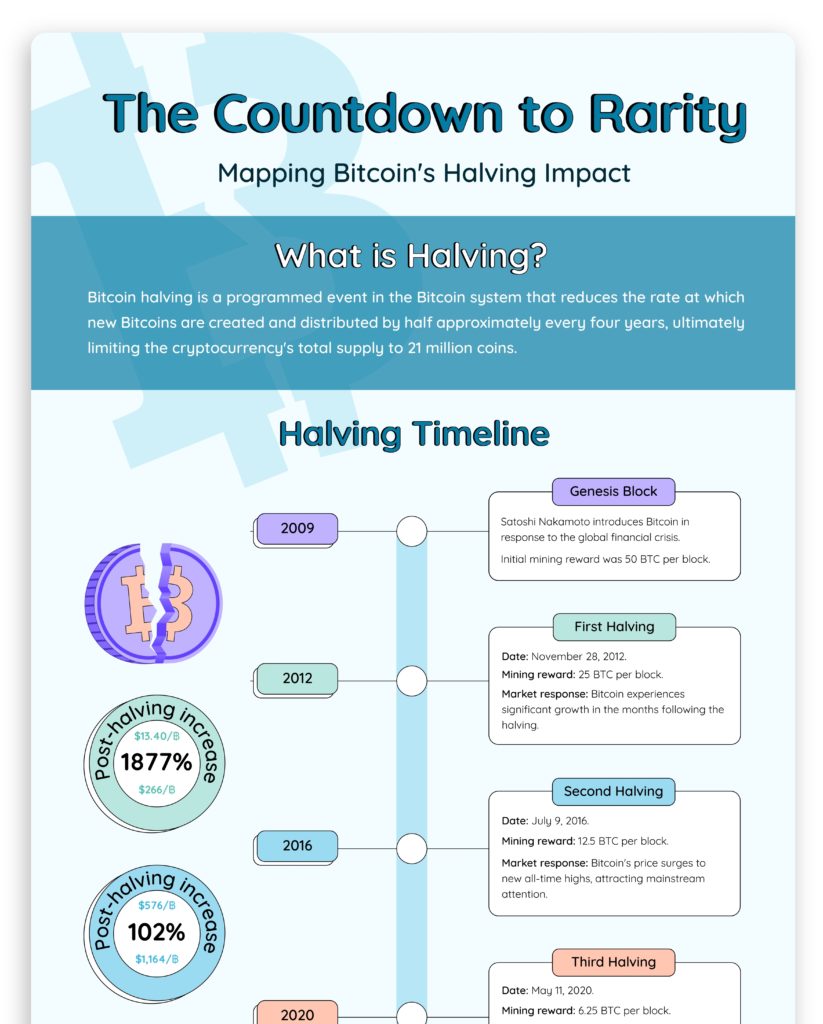

Bitcoin halving is a programmed event that occurs approximately every four years or every 210,000 blocks and has significant implications for the Bitcoin network. It entails halving the reward given to miners for processing transactions and adding new blocks to the blockchain. By reducing the rate at which new bitcoins are generated, halving serves the critical purpose of controlling Bitcoin’s supply, ultimately maintaining its finite nature with a maximum cap of 21 million coins. Similar to precious metals like gold, this scarcity contributes to Bitcoin’s value proposition. The occurrence of halving events embedded within the Bitcoin protocol triggers speculation, media attention, and price volatility. The historical precedents of Bitcoin halvings, from the first in 2012 to the most recent in 2020, have consistently sparked notable price surges and heightened interest in the cryptocurrency landscape.